5-year financial forecast is strong, stable

A strong, growing local economy over the next five years will provide the City of Round Rock an opportunity to lessen its reliance on a single, major taxpayer to fund operations, but will put upward pressure on expenses and salaries, according to a forecast by Susan Morgan, City Chief Financial Officer.

The COVID-19 pandemic does not appear to be having a negative long-term impact on the City’s financial picture, Morgan said. To the contrary, it has given the City an opportunity for “a great reset” as expenses have gone down over the past 18 months while revenues have kept growing, Morgan told the Round Rock City Council during a June 8 presentation.

The reset will allow the City to consider increasing the number of capital projects it pays for with cash as opposed to paying for with debt, which puts upward pressure on property tax rates.

The forecast assumes 2.5 percent annual population growth from FY 2022 through FY 2026, strong local development and economic growth, and a strong and stable state and national economic outlook.

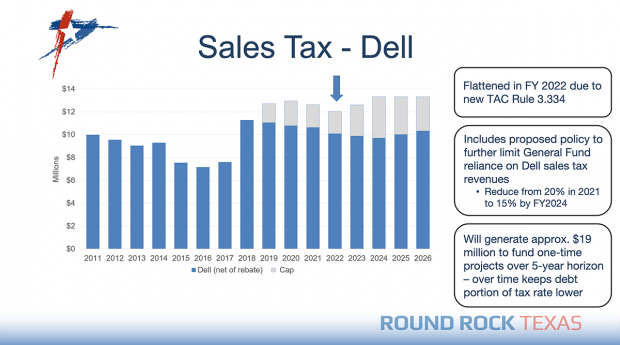

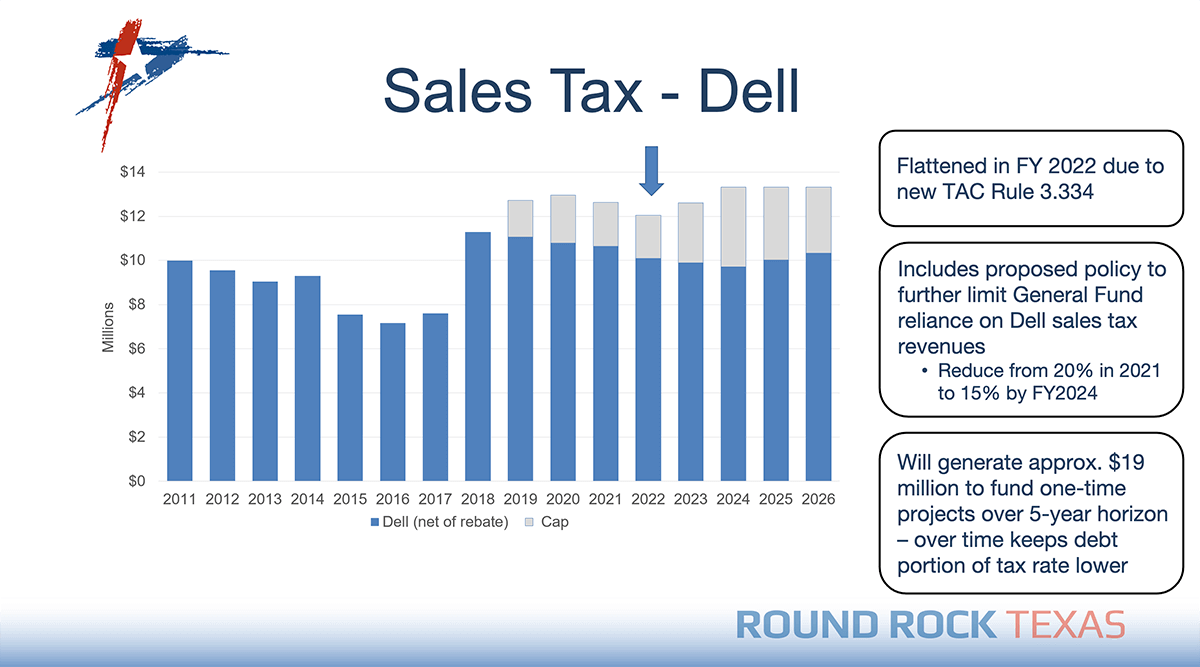

Morgan is recommending the City consider limiting the sales tax revenue from Dell Technologies to 15 percent of General Fund revenues. By policy, Dell revenue is currently limited to 20 percent. Any revenue above that 15 percent cap (see chart) would be used to fund one-time projects, which Morgan projects would grow to $19 million over five years.

For many years, the City has worked to reduce its reliance on Dell. In fiscal 2006, property taxes were 18 percent of general fund revenues with heavy reliance on sales tax, especially from Dell. The long-term goal has been to create more stable funding mix between property tax and sales tax. Economic development efforts and other growth in new property have contributed greatly to more stable financial structure while maintaining low tax rates.

Revenue assumptions

Overall, Morgan projects sales tax revenue to grow at 4 percent annually through fiscal 2026.

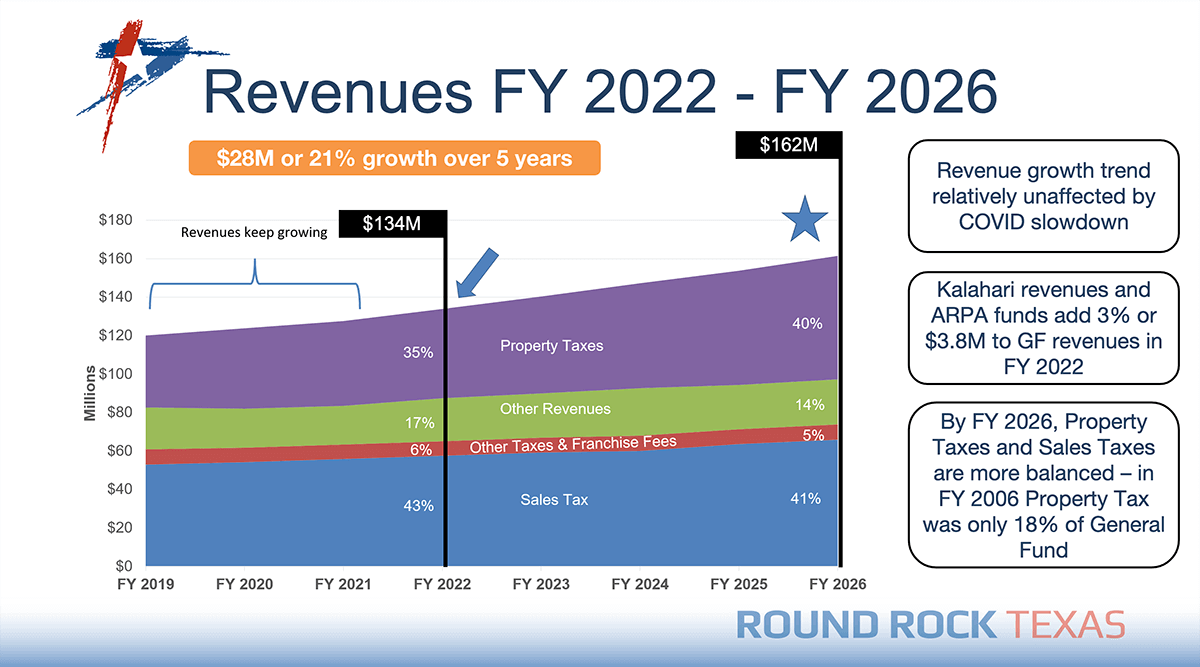

By reducing reliance on revenues from Dell and incrementally increasing property tax revenues to pay for maintenance and operation costs, the City can achieve a more stable revenue balance, Morgan said. By 2026, the proportion of sales tax revenue and property tax revenue would be about equal. Currently, sales tax revenues comprise 43 percent of revenues, with property taxes at 35 percent. (see chart).

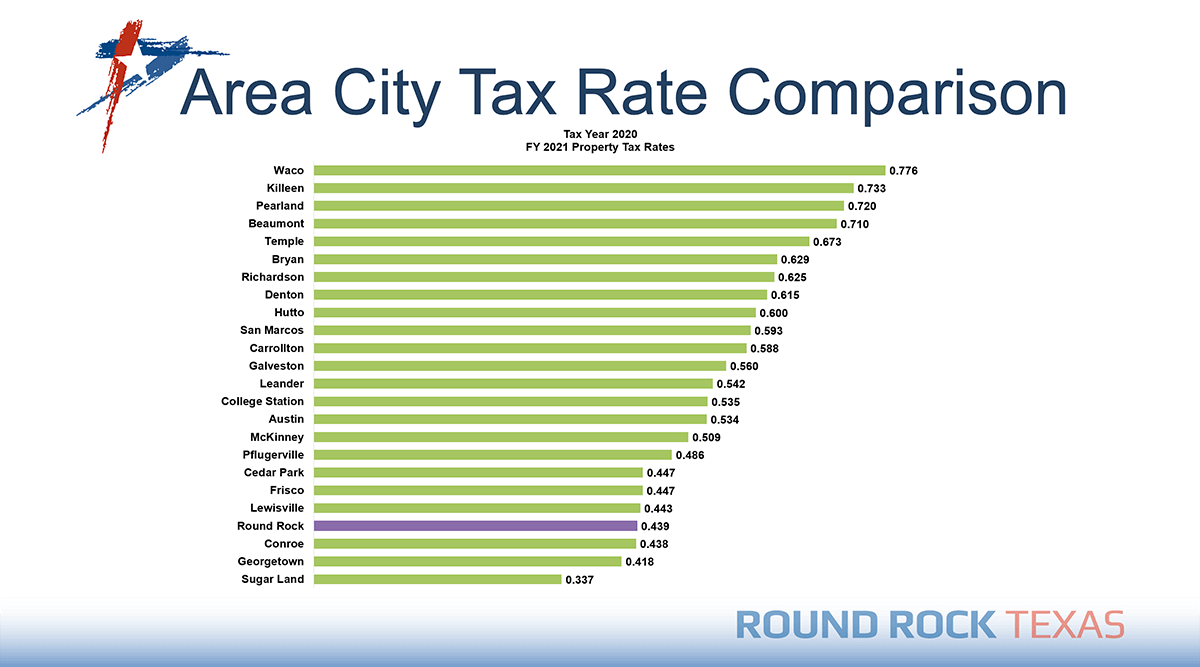

In the forecast, the projections assume the maintenance and operations component of the property tax rate would be increased at 3.5 percent annually. While increasing property taxes isn’t popular, the City’s property tax rate is among the lowest of comparable cities in Texas, Morgan said. (see chart)

In fiscal 2022, there is expected to be $407 million in new properties added to the tax roll. In ensuing years, the City expects $350 million in new properties per year, Morgan said.

New properties coming onto the tax rolls each year are projected to generate $1.5 million to $2 million in new revenues. Mayor Craig Morgan noted that’s not enough to cover planned increases in police and firefighter salaries.

Cost assumptions

Salaries are projected to increase 4 to 5 percent a year to stay competitive, Susan Morgan said. Health insurance and pension costs should remain stable, and operating costs are projected to increase 1 percent annually.

City staff is projected to grow by 104 positions over the next five years to meet project demands and population growth. The City expects to open two new fire stations, and complete a new, larger library, and hire new police and transportation personnel.

There is a manageable gap between revenues and expenses through fiscal 2026, Morgan said, that can be covered through stronger than projected sales tax revenues or through expense reductions.

Morgan said her forecast did not include projections from the major projects that recently announced: Switch is building 1.5 million square feet of space at the Dell Technologies campus. The District is expected to break ground later this year on a 65-acre mixed use project with 1 million square feet and a minimum investment of $200 million.

Conclusion

The five-year outlook is strong and stable, and closing the gap between project revenues and costs is doable, Morgan said. The City must remain vigilant on sales tax reliance by reducing dependency on Dell, monitor changing economic indicators and trends carefully, and maintain a one-year lag on spending any general fund surplus revenues.

The City should continue to diversify the local economy – as was done with the recruitment of Kalahari – as well as focus on self-financing projects whenever possible instead of issuing debt. Ensuring funding is available to maintaining streets, parks and vehicles should remain a priority. Finally, Morgan said, the City should move quickly to adapt if economic conditions change, as it did last year when the pandemic hit.

The five-year forecast is a strategic planning tool for the City Council as it prepares for budget deliberations later this summer. It is also a requirement of the City’s financial policies and a critical part of the City’s strategic goal to be a financially sound city providing high value services.

The post 5-year financial forecast is strong, stable appeared first on City of Round Rock.

Source: City of Round Rock